Recent updates 🗞️

🎅 Santa Claus rally confirmed; S&P and NASDAQ ATH

🤖 Nvidia acquires Groq for $20bn

⭐️ Gemini 3 ends the year as best LLM model as per Kalshi polls

🎥 Watched “Die Hard” on Christmas eve 🎄

📚 Reading “Empire of AI” by Karen Hao

YTD Portfolio Performance: +55.09% YTD

In my personal investment journal, I’ve stopped tracking daily price movements. Instead, I track critical thresholds—specific numerical triggers that, if breached, signal a fundamental shift in the reality of the market. These aren’t just “dips” or “rallies”; they are phase changes.

Below are the three specific signals I am monitoring right now. They cover the macro plumbing of the world, the shifting business model of software, and the physical manifestation of AI.

The Macro: The Great Unwind (Japan)

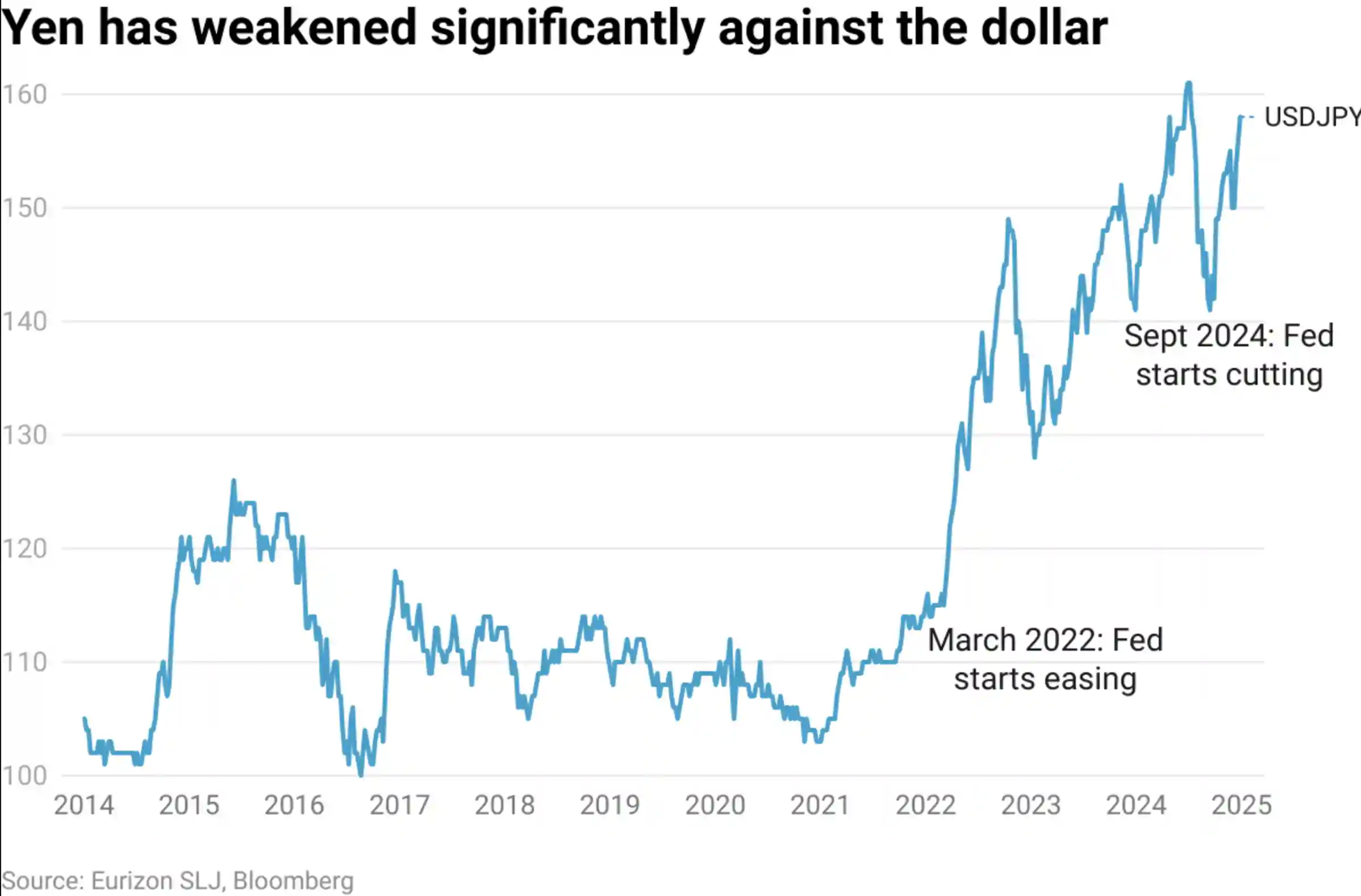

Everyone is looking at the S&P 500. I am looking at the Japanese Yen.

For decades, the “Carry Trade” has been the free money engine of the global economy. Investors borrow Yen at near-zero interest rates and invest it in US Tech stocks or high-yield bonds. It’s a massive, invisible leverage trade that props up asset prices globally.

But the engine is sputtering.

The Signal: USD/JPY Exchange Rate breaks below 130.

Why It Matters: If the Yen strengthens past 130 (we are currently hovering in the 150s), the math breaks. The “free money” loan becomes expensive to pay back. Institutional investors will face margin calls, forcing them to sell their most liquid assets (US Stocks, Crypto) to cover their Yen debts.

This is the “butterfly effect” in action. A policy tweak in Tokyo can crash a portfolio in Texas. I am watching the MOVE Index (bond market volatility). If that sustains above 120, it means the plumbing is leaking.

My Take: Don’t panic over daily stock drops. Panic when the bond market breaks. Until then, it’s just noise.

The Business: From “Tools” to “Labor” (Agentic AI)

We are witnessing the death of the “Per Seat” business model.

For the last 20 years, SaaS (Software as a Service) companies like Salesforce or Slack charged you for every human using their tool. But if AI Agents start doing the work, who pays for the seat?

The Signal: A shift to “Outcome-Based” Pricing.

Why It Matters: Watch the earnings calls of major SaaS players. When they stop charging $30/month per user and start charging $1.00 per resolved customer support ticket, the shift has happened.

This is a deflationary bomb for the enterprise. I am specifically looking for “OpEx Deflation” in Fortune 500 guidance—COOs explicitly stating they are reducing headcount because “Agentic AI” (models that do, not just chat) is handling the workflow.

Recommended Reading:

Andrej Karpathy - “2025 was an exciting and mildly surprising year of LLMs. LLMs are emerging as a new kind of intelligence, simultaneously a lot smarter than I expected and a lot dumber than I expected. In any case they are extremely useful and I don’t think the industry has realized anywhere near 10% of their potential even at present capability.”

The Future: The “Model T” Moment (Robotics)

I admit, I was a skeptic. But the hardware data is becoming undeniable. We are approaching the “PC moment” for humanoid robotics—the point where a luxury toy becomes a household appliance.

The Signal: A functional humanoid robot (Tesla Optimus, Figure 01) priced under $25,000.

Why It Matters: $25,000 is the psychological anchor. It is the price of a mid-range car (or a kitchen remodel). If a robot costs $100k, it’s a factory tool. At $25k, it is an upper-middle-class consumer product.

I am watching for Regulatory Certification. Just as we have safety standards for toasters and cars, the EU or US will soon draft a “Mobile Manipulator in Domestic Settings” standard. Regulation sounds boring, but it is the precursor to mass adoption. You can’t sell a million units until the government agrees they won’t kill the cat.

Investment Thesis: The hardware is easier to copy than the data. The winner won’t be the robot with the best hands; it will be the robot with the best “brain” trained on millions of hours of real-world chaos.

Final Thought

Marcus Aurelius wrote, “You have power over your mind - not outside events. Realize this, and you will find strength."

We cannot control the Bank of Japan, the pricing strategy of OpenAI, or the speed of Tesla’s assembly line. But we can control our thresholds. By defining exactly what needs to happen for us to change our strategy, we remove the emotion from the decision.

Stay thoughtful.

Current signals status:

USD/JPY: ~156 (Safe, for now)

Agentic Pricing: Emerging (Keep watching)

Robot Price: ~$20k-$30k target (Approaching)

Cheers 🥂