Recent updates 🗞️

📈 S&P500 crosses 6000, Nasdaq 100 crosses 21,500

🇸🇾 Bashar al-Assad and Assad reign in Syria ends after 54 years

🇺🇸 Trump threatened 25% tariffs on imports from Mexico and Canada

🎓 Capstone completed 🎉

🎥 Searching for what to watch!

📚 Finding my next book to read!

Transforming Value Investing Through a Tech Lens: My Contrarian Strategy

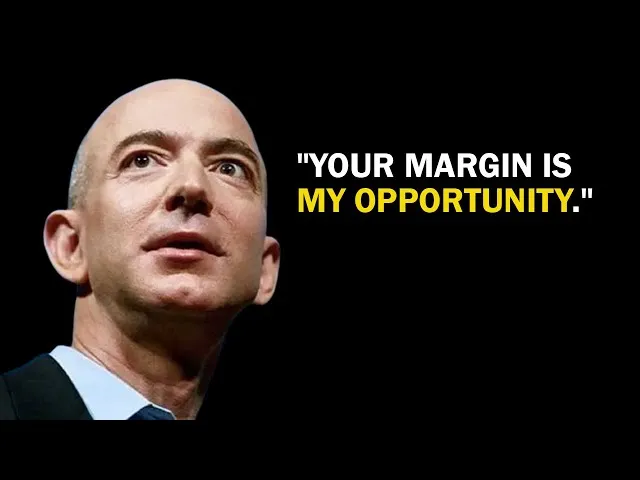

Wrapping up 2024 with a topic that resonates with me and has engrossed me for the past couple of years. As a techie who’s now diving deep into the world of finance, I’ve become fascinated by how Jeff Bezos’ iconic quote “Your margin is my opportunity” perfectly encapsulates my evolving investment philosophy. This isn’t just a catchy phrase—it’s a powerful framework for value investing that challenges traditional market thinking.

Amazon delivered better prices by removing the costs added by the middlemen in the retail supply chain

The Contrarian Mindset

My journey as an investor isn’t about following the crowd. It’s about seeing what others miss. When everyone else is frantically trading or panicking, I’m looking for the hidden gems that the market has overlooked. Warren Buffett’s famous advice to “be fearful when others are greedy, and greedy when others are fearful” resonates deeply with me.

Deconstructing Margins and Opportunities

Bezos’ philosophy is brilliantly simple. When established businesses become comfortable with their profit margins, they create vulnerabilities. As a value investor, I see these high margins not as a sign of success, but as an invitation for disruption. Whether it’s in tech, finance, or traditional industries, there’s always an opportunity to provide more value at a lower cost.

My Investment Approach

I’m not interested in quick wins or following market trends. My strategy is about deep research, understanding intrinsic value, and having the patience to wait for the right moment. This means sometimes holding significant cash when I don’t see compelling opportunities, and being willing to go against conventional wisdom.

Embracing Uncertainty

Value investing isn’t about eliminating risk—it’s about understanding and managing it. By seeking a margin of safety and maintaining a long-term perspective, I can navigate market volatility with confidence. My tech background has taught me that the most significant opportunities often emerge from periods of uncertainty. In the end, my investment philosophy is about more than just numbers. It’s about seeing the world differently, having the courage to act on independent research, and understanding that true value often lies beneath the surface of what the market currently perceives.

Cheers 🥂