Recent updates 🗞️

🇮🇱 Israel attacked by Iran with missles and drones, no loss of life

📈 Dimon warns US interest rates could climb to 8%, sells $183mn in JPM stock

🇮🇳 Elections begin in India

🎓 Learning Corporate Finance and Pricing Strategy!

🎥 Watching “The Bear” S2

📚 Reading “Hot Seat: What I Learned Leading a Great American Company” by Jeff Immelt

US & China’s Debt Surge: IMF Warns of Global Economic Impact

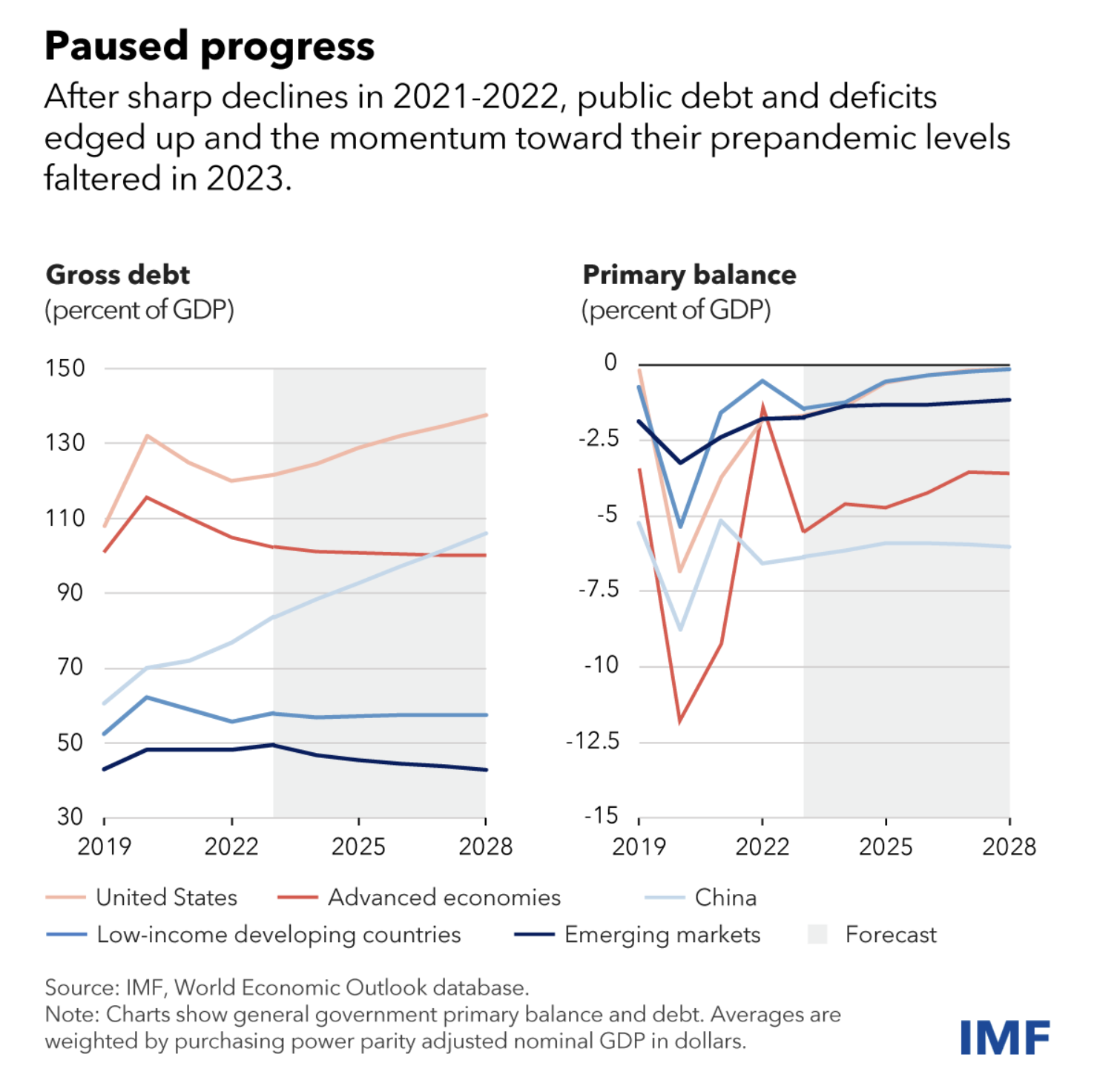

The ballooning national debts of the United States and China pose a looming threat to the stability of the global economy. In a stark warning, the International Monetary Fund (IMF) has outlined a surge in borrowing by these two economic superpowers, highlighting the urgent need for policy changes that can reverse this troubling trend.

IMF Report

According to the IMF’s latest assessment, the US and China stand as exceptions to the general trend of debt reduction that’s taking hold among many wealthy nations in the post-pandemic era. In fact, under current policies, the US debt-to-GDP ratio is projected to grow by a staggering 70% by 2053. China’s trajectory is even steeper, with its debt anticipated to more than double in the same period. This unconstrained growth in borrowing will fuel a significant rise in global government debt levels over the next several years.

US & China's Debt Surge

US Debt Crisis

The IMF singles out the US as suffering from “large fiscal slippages” with runaway spending outpacing revenues. The persistent budget deficit paints a worrying picture – it hinders efforts to curb inflation and could lead to higher interest rates not just domestically but for other indebted countries around the world. The ripple effects are already being felt in the US Treasury bond market, where investor concerns about the massive influx of government debt are becoming evident.

China Debt Crisis

China, despite seeing a modest decrease in its budget deficit in 2023, faces different but equally concerning factors. The IMF report flags the possibility of Beijing’s economic slowdown, the consequences of which could include a weakening of essential aid flows to developing nations that rely heavily on Chinese support.

Conclusion

The fiscal realities presented in the IMF analysis underscore a critical point: 2024, a significant global election year, is a crossroads. The confluence of elections across many countries, along with heightened demands for public spending, creates a scenario where the political will for fiscal responsibility will be put to the test. Without bold action and a willingness to confront difficult spending choices, we risk pushing the world economy down a path of instability, higher interest rates, and economic hardship. The time to address this debt crisis is now.

Cheers 🥂